The OBBBA Made a Small Change to Disguised Sale Rules — But It Could Have a Big Impact on Partnership Tax Planning

A subtle change tucked into President Trump’s One Big Beautiful Bill Act

significantly alters how the IRS evaluates partnership transactions. The question now becomes: are transfers genuine contributions and distributions, or do they constitute a disguised sale? The revisions to IRC Section 707(a)(2) of the tax code will prompt taxpayers and their advisors to reconsider how they structure transactions between partners and their partnerships.

In this discussion, we will cover:

- What are the IRC Section 707 disguised sale rules for sale of a partnership interest?

- What did the OBBBA change?

- What does this change mean for partnerships and their partners?

What are the IRC Section 707 disguised sale rules for sale of a partnership Interest?

IRC Section 707(a)(2) comes into play when a partner transfers cash or property to the partnership and shortly thereafter the partnership distributes cash or property to another partner to reduce the distributee partner’s interest in the partnership. If the IRS determines these steps are connected—even if they appear separate and occur at different times, the transaction can be recharacterized as a disguised sale of a partnership interest.

This reclassification changes the treatment from what taxpayers might expect (such as a tax-free liquidation) to a taxable sale, which can trigger gain recognition and lead to unexpected tax liabilities.

In short, these rules exist to prevent taxpayers from structuring what is essentially a sale of a partnership interest as a non-taxable transaction between the partnership and its partners.

What did the OBBBA change?

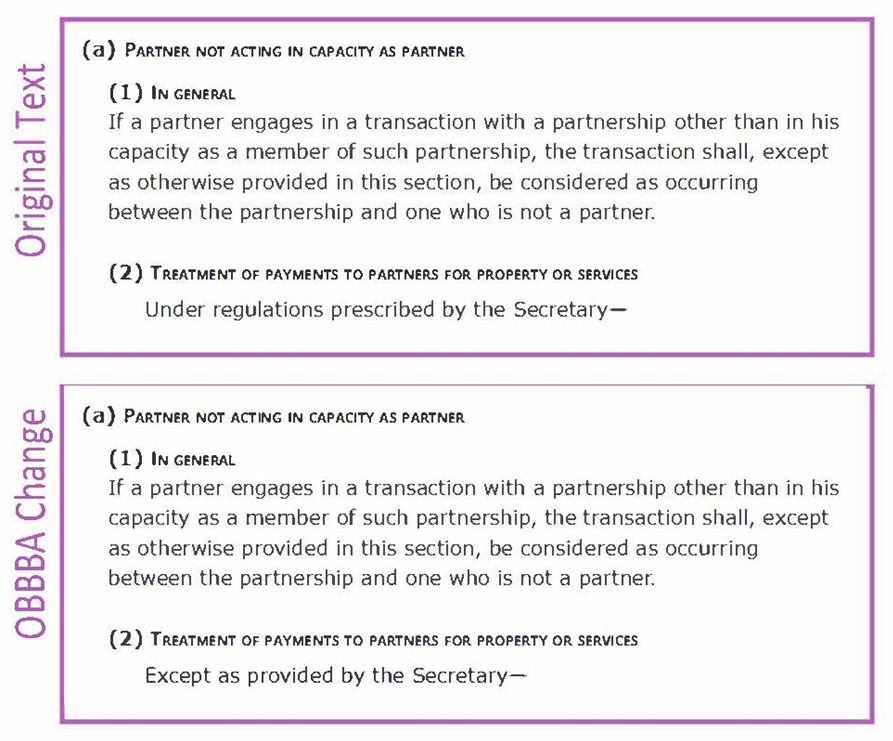

The OBBBA made one minor change to IRC Section 707(a)(2). It replaced the words, “under regulations prescribed by the Secretary” with “except as provided by the Secretary.”

This may not sound like a big change, but it is. This change eliminates any ambiguity about the enforceability of the disguised sales rules with respect to transactions between a partnership and its partners.

Before the OBBBA, many taxpayers argued that the IRS lacked authority to enforce the disguised sale rules under IRC Section 707(a)(2) because the statute stated they applied “under regulations prescribed by the Secretary.” Since those regulations were never finalized—some claimed there was no statutory basis for IRC Section 707(a)(2) at all. By changing the language to “except as provided by the Secretary,” the OBBBA signaled that these rules are now self-executing, meaning they apply even without additional regulatory action.

What does this change mean for partnerships and their partners?

The new self-executing language in IRC Section 707 closes a long-standing loophole. Partners who previously relied on ambiguity in IRC Section 707(a)(2) to structure tax-free transfers will now need to rethink their strategies.

Historically, Treasury regulations finalized in 1992 addressed disguised sales of property but were silent on disguised sales of partnership interests. This gap led taxpayers to argue that, without additional regulations, such transactions were unenforceable. With the OBBBA’s amendment, that loophole is gone: all transfers—whether of property or partnership interests—are now subject to the disguised sale rules.

Although the change became effective immediately upon its enactment on July 4, 2025, the OBBBA clarifies that no inference should be drawn regarding prior transactions—indicating the rule was intended to apply all along. Reach out to your Meaden & Moore tax advisor for more information.

Angelina is a Vice President in Meaden & Moore's Tax Services Group with more than 30 years of experience.