Wealth Center

When it comes to building, managing, and preserving your wealth, the Wealth Center at Meaden & Moore can show you the way.

Building a Bright Future

Our wealth management advisors can develop a strategy specifically tailored to your personal financial goals – both short-term and long-term. Whatever your concerns and objectives, we can help you develop a plan for financial security for you and your loved ones.

At the Wealth Center at Meaden & Moore, your goals are always at the forefront. We assemble a team with expertise in the areas most important to your success, including, tax experts, business consultants, estate attorneys, and retirement planners.

Personalized Advice

Thinking about how you can accumulate more wealth today? Protect your wealth for tomorrow? Maintain your lifestyle during retirement? You might also be thinking about how and when to begin transferring wealth to your loved ones to minimize estate and gift tax.

Whatever your concerns and objectives, we can help you develop a plan for financial security for you and your loved ones. We can help you plan for your financial future, develop a multi-generational strategy for sharing your wealth, design your portfolio, manage your investments, and minimize your tax burdens.

Family Business Guide

It may seem like you have a lot of time to prepare, but you never know when and how you will need to exit your business. Get our guide that will walk you through the steps of your business succession plan.

Tax Planning

Planning and foresight can turn those implications to your advantage. Meaden & Moore can show you how. Our professionals actively follow changes in tax laws and rulings, and we share that information with our clients. We go well beyond simple documentation to provide counsel and education – instilling confidence in your personalized tax strategy.

Our tax planning professionals will evaluate income from your employment, investment holdings, and other sources to develop a strategy for minimizing the income tax you pay.

Every Financial Transaction Has Tax Implication

We can assist when you face family, business, or investment decisions that might have tax implications. In addition, you can trust our team of experts to help with your estate planning, investment planning, business succession planning, and retirement planning needs.

Tax Planning Guide

A comprehensive guide to help you prepare business and personal taxes for 2024–2025. With tax law changes already in effect for 2024 and potential updates on the horizon, you may have questions about tax planning this year.

Estate & Gift Planning

Effective estate planning is best viewed as a process – not a one-time event – that involves a complex mix of personal, financial and legal interactions. The goal of estate planning is to transfer your assets to specific individuals and/or institutions in the most efficient manner.

The Wealth Center professionals at Meaden & Moore can help you explore a wide range of estate planning strategies. Our creative solutions will enable you to create a legacy, while also minimizing taxes and extending your values and vision across future generations.

Changing With the Times

After executing your plan, we will monitor it on a regular basis to ensure that it reflects your changing personal situation and adheres to evolving tax laws. Communications such as these regarding your goals and objectives – coupled with our commitment to clients – instill confidence and trust in Meaden & Moore's Wealth Center team.

Planning for Your Financial Security?

Schedule a consultation with our Wealth Center advisors who will be happy to assist you.

Insurance & Risk Planning

No matter how elaborate the investment portfolio or retirement plan, without proper risk management, all planning efforts could be moot. Every wealth protection plan must focus on securing financial assets, as well as safeguarding your current and future lifestyle.

Meaden & Moore's wealth management professionals have extensive experience addressing our clients’ insurance and wealth protection concerns. We help clients audit their existing insurance policies – life, long-term health, disability – by applying Meaden & Moore's comprehensive approach to wealth management.

Meeting Your Changing Insurance Needs

Even as circumstances change, financial markets grow, and family priorities evolve, we can help ensure your insurance plans fit within your overall financial objectives. Work with the experts at Meaden & Moore to develop a plan designed to evolve as your needs change.

A Simple Introduction to Valuation

Valuations are necessary for many tax-related matters as well as various transactional settings, however, they require more than simply applying technical models. Valuation is also about understanding business operations, economic conditions, and tax laws.

Investment Planning

Effective investment planning often spans years or decades. During that time, your focus might shift between wealth accumulation, wealth preservation and ultimately, the transfer of wealth.

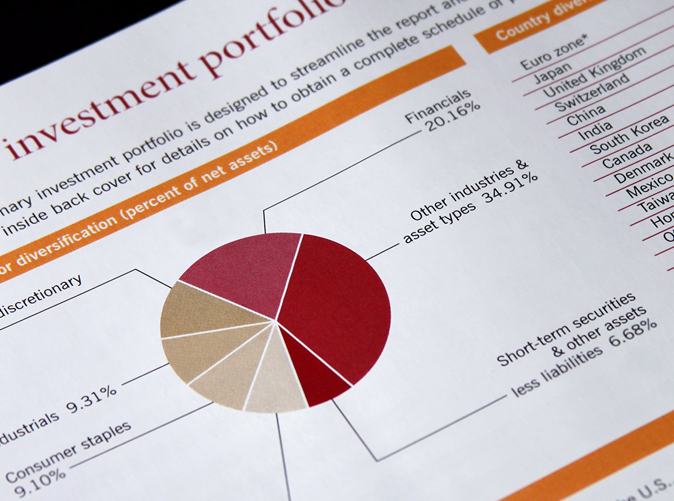

Meaden & Moore's Wealth Center investment philosophy begins with understanding the unique investment goals and investor profile of each client. After a thorough discovery phase, we begin to formulate a customized program. The Wealth Center professionals will identify your investment time horizon, risk tolerance, liquidity needs, and tax implications. This information will set the parameters for your customized portfolio.

Distributing Your Assets Enhances Results

Our professionals utilize a tax efficient investment approach based on the principles of modern portfolio theory. Following this disciplined process, we allocate your financial resources across asset classes and distribute your portfolio among a variety of investments. This strategy helps reduce volatility and increase the probability of attaining your investment objectives.

Important: The projections or other information generated regarding the likelihood of various investment outcomes are hypothetical in nature. They do not reflect actual investment results, nor do they guarantee future results.

Getting the Help You Need

Schedule a consultation with our Wealth Center advisors who will be happy to assist you.

Retirement Planning

Whatever your retirement dreams, the Wealth Center can help you set goals and build an actionable plan that helps you prepare for the challenges and financial risks you’ll face during your retirement years.

For individuals, retirement planning can be quite complex; business owners face even greater complications.

In addition to diligently saving for your personal retirement, you must also consider your business succession plan. Meaden & Moore can help you evaluate the impact your retirement will have on your family, your business, and your employees.

Creating a Comprehensive Strategy

Retirement planning involves more than wealth accumulation – it also affects education planning, estate and income protection, investment planning, and more. The Wealth Center at Meaden & Moore is standing by to help you create a comprehensive strategy that meets all these needs.

Family Business Resources

Our carefully selected family business resources—including expert blogs and insightful guides—are tailored to help you navigate the unique challenges and opportunities you face.

Succession Planning

It may seem like you have a lot of time to prepare, but you should plan when and how you will exit your family business long before you need to do so. The creation of a solid succession plan now can guarantee a smoother transition for your company later on.

Succession planning involves more than staff replacement. It should support your business goals, create a sound structure, and facilitate the growth and the smooth functioning of your company for years to come.

Succession and Strategic Planning Work Together

Are you ready to retire, but your company isn’t ready for that kind of change? When you work with Meaden & Moore to create a business succession plan, we’ll carefully consider your organization from many important angles:

- Cash flow and financial planning for the owner

- Family harmony

- Management succession

- Ownership succession

- Tax issues

Your Meaden & Moore team takes a comprehensive approach to creating your business succession plan, customized to your organization. In the process, we will engage the appropriate professional advisors, identify the goals of the business, owners and stakeholders, and work together to develop, implement, and monitor your succession plan.

Planning for Your Financial Security?

Schedule a consultation with our Wealth Center advisors who will be happy to assist you.

Meet Our Experts

At Meaden & Moore, our people are our most vital asset, providing the strength behind our reputation, technical excellence, and top-notch quality service. Wherever your business operates, you can count on the leaders at Meaden & Moore to provide the comprehensive services you need.