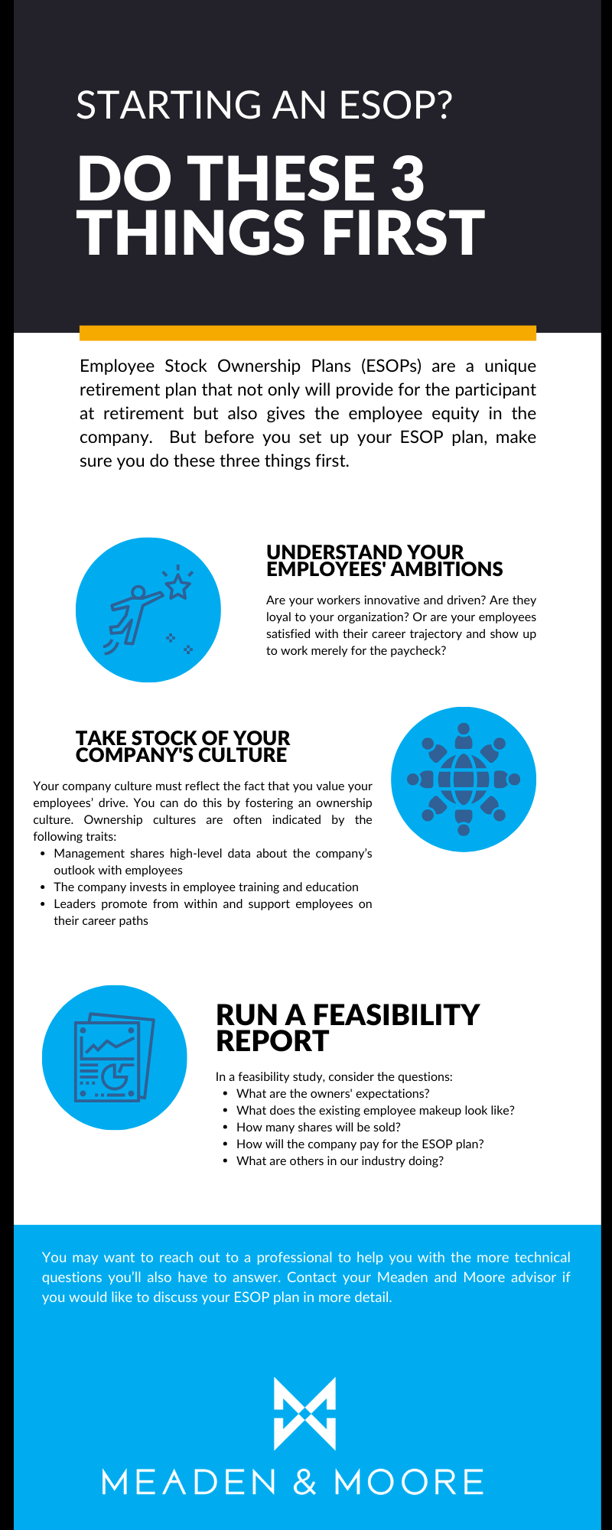

Starting an ESOP? Do These Three Things First

Employee stock ownership plans (ESOPs) are a unique retirement plan that not only will provide for the participant at retirement but also gives the employee equity in the company. As we discussed in a previous article, ESOPs can satisfy a wide variety of needs. But before you set up your ESOP plan, make sure you do these three things first.

ESOP Process

1. Understand Your Employees’ Ambitions

Are your workers innovative and driven? Are they loyal to your organization? Or are your employees satisfied with their career trajectory and show up to work merely for the paycheck?

Employees who have enthusiasm for the work you do (and who stick around long enough to help see those initiatives through) will be the ones who see starting an ESOP as a worthwhile reward for their loyalty. These folks can be referred to as intrapreneurs: individuals who are employed but have entrepreneurial drive. Intrapreneurs inject creativity, passion, and vision into the workplace, and they are the ones who will want to play a role in your company’s success.

2. Take Stock of Your Company’s Culture

Simply having motivated employees isn’t enough. Your company culture must reflect the fact that you value your employees’ drive. You can do this by fostering an ownership culture. Ownership cultures are often indicated by the following traits:

● Management shares high-level data about the company’s outlook with employees

● The company invests in employee training and education

● Leaders promote from within and support employees on their career paths

● Owners employ profit-sharing tools to reward employees for their hard work

● Supervisors ask for employee input and welcome feedback from any level

A company whose culture provides employees with the freedom to act and make decisions like owners – and employees who gladly step into those roles – will benefit from an ESOP.

3. Run a Feasibility Report

When employee incentive aligns with the organization’s, you can more strongly consider an ESOP. But you must first see if it would be feasible for your organization and for the existing owners. Because starting an ESOP is predicated on either purchasing or diluting the shares of the existing owners, you should ensure the transactions will benefit your current owners first. In such a feasibility study, ask yourself the following questions:

● What are the owners’ expectations? Shares cannot be purchased at anything other than fair market value, and existing owners may have no idea what their company is worth. Perform a valuation study so that all parties can consider value-per-share.

● What does the existing employee makeup look like? Consider your turnover rates and the age of your workforce to get a better idea of who would receive benefits under the ESOP. You must be confident that your workers would value stock benefits.

● How many shares will be sold? How closely-held do the owners want the business to be in five, 10, 20 years? Do they want to sell some or all their shares? This will help you determine what shares will be included in the ESOP plan.

● How will the company pay for the ESOP plan? Some companies will fund the ESOP with cash, but others will do so with financing. Know how you will purchase new or existing shares.

● What are others in our industry doing? If others in your industry offer ESOPs, will yours look competitive to potential recruits?

Many of these “big picture” questions you can answer for yourself, but you may want to reach out to a professional to help you with the more technical questions you’ll also have to answer, like:

● How does my existing 401(k) mesh with an ESOP?

● Can our cash flows support this ESOP plan?

● Will stock sales impact our (or our owners’) tax return?

● Are our owners eligible for tax deferral?

● Who can we legally exclude from or include in the ESOP?

● Will our ESOP shares vest? Over what period?

● Who will be the ESOP plan’s trustee?

● What repurchase obligations should we have in the event of death, disability, or retirement?

Contact your Meaden and Moore advisor if you would like to discuss your ESOP plan in more detail.

Michelle Buckley is a Vice President in Meaden & Moore’s Assurance Services Group with 23 years of public accounting experience.