Strategies to Help Weather Major Market Swings

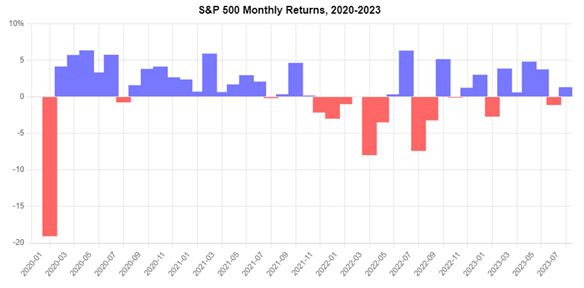

It has been a brutal couple of years for investors, banks, lenders, and borrowers. The stock market took massive swings when COVID-19 first emerged and in the months that followed. Even in the most recent months, returns have been inconsistent, leaving US investors uncertain about the future.

Source: Official Data Foundation

Unpredictable markets can be difficult to manage, but there are a few best practices you can employ to weather big market swings.

But first, what is market volatility, and what causes it?

Market volatility is when groups of stocks or bonds rapidly change price in a short time. One of the most common indexes for measuring market volatility is the VIX, or the “volatility index.” The VIX gauges investors’ expectations about where stock prices are headed over the next 30 days. In general, the higher the VIX, the riskier the market. The VIX is also commonly known as the “fear index” because it gauges the degree of fear among market participants.

Market volatility can be caused by many different factors.

Interest rates

If investors anticipate interest rates will increase, stock prices tend to rise, and that’s because investors know that the cost of borrowing will affect corporate profits.

- When capital is more expensive to obtain, corporate profits take a hit.

- To compensate, corporations often raise the prices of their products and services.

- When products and services become more expensive, consumers are left with less disposable income to stimulate the economy.

Interest rate changes don’t affect the economy immediately; the International Monetary Fund has reported that it can take up to 12 months for interest rate changes to affect the economy. But because stock prices reflect investors’ perceptions, stock prices will reflect interest rate changes almost immediately.

Legislation

When subsidies, tariffs, taxes, or new regulatory requirements are passed, stock prices will change if investors believe that those legislative changes are going to affect a company’s or an industry’s profitability.

Economic Reporting

As new information is released, investors respond. When the government releases new data about unemployment, inflation, industrial output, product prices, sales numbers, etc., investors take that information into consideration and adjust their investment mixes as needed.

Geopolitical Risks

World events like presidential assassinations, bombings, declarations of war, humanitarian crises, terrorist attacks, and other events of political unrest have historically caused the stock market to fall as investors get wary of how businesses will be affected.

Individual Company Performance

Company stock prices can change when performance reports emerge. An announcement of a new product or expansion, the death of a key leader, or an uncoupling from a business partner can also cause investors to gain or lose confidence.

How to Navigate Volatile Markets

Volatile markets are—by definition—unpredictable. The best way to weather those large market swings is to put a plan in place and stick to it. Here are three strategies to consider.

1. Create and rely on a long-term plan.

It can be too easy to let our emotions affect our investment decisions. When stock prices fall, many of us react emotionally and want to bail on those losing investments. This phenomenon, called the “emotional investing cycle,” is something you want to steer clear of.

Having a long-term plan helps you stay calm even when your emotions tell you that you need to make a change. Staying the course and ignoring short-term fluctuations is almost always the best way to reliably turn a profit over the long term.

2. Take advantage of the opportunity.

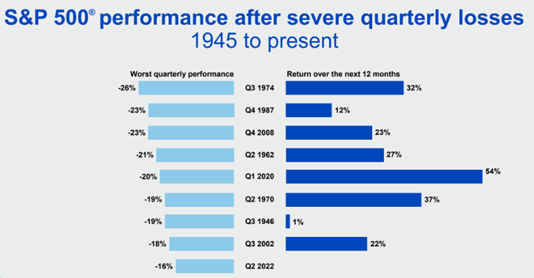

It may seem contradictory, but it may be smart to invest when stock prices fall. Historically, the stock market has rebounded quickly after experiencing even severe losses.

If you have a long-term mindset, investing when prices are low may help you see an even larger return when all is said and done.

3. Have an investment mix that aligns with your goals.

Spreading your investments across a wide range of options helps protect you from market volatility. Diversification isn’t a new concept, but if you think about finding a diversification strategy that aligns with your goals, your portfolio will be even stronger. For example, in general, the more we age, the more we want to weight our portfolio more heavily toward lower-risk investments. Although low-risk investments tend to have lower rates of return, your portfolio is less likely to be in a loss scenario when you’re ready to retire. Figure out what your goals are and what your appetite for risk is and build your diversified portfolio accordingly.

It's Not too Late to Build a Solid Investment Plan for 2024

Market swings are difficult to navigate, but they are more of a mental challenge than anything else. If you can control your emotional response to seeing the market dip, you are in a much better position to make investment decisions that will serve you well over the long term. If you want to discuss your market strategies with one of our Meaden & Moore advisors, reach out to us today and we can help you build that strategic plan. For more information about Strategies to Help Weather Major Market Swings, reach out to us today.

Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC. Investment Management Solutions (IMS) Platform fee-based asset management accounts offered through Avantax Advisory ServicesSM. All other financial planning services are offered through The Wealth Center at Meaden & Moore. The Wealth Center at Meaden & Moore is not affiliated with Avantax Investment ServicesSM. Insurance services offered through an Avantax affiliated insurance agency.