The Inflation Reduction Act Boosts Energy Credits …. But it is Not Without Issues

The Inflation Reduction Act of 2022 (IRA) revamped the nation’s energy tax credit program, making it easier to take advantage of credits that were historically out of reach. Two key provisions Internal Revenue Code (IRC) Section 6417 & IRC Section 6418 of the Act provide the opportunity to better monetize the credits, by allowing for refundability or transferability. However, additional guidance is necessary to resolve various issues.

Why were energy credits so inaccessible?

Until this year, most federal energy credits were nonrefundable and nontransferable (other than through a complex syndication process), which meant that investors in clean energy only benefitted when they had an income tax liability that could absorb the credits. Nonprofit organizations (and for-profit businesses reporting a tax loss) had no federal tax incentive to invest in clean energy.

How did the Inflation Reduction Act improve access to energy credits?

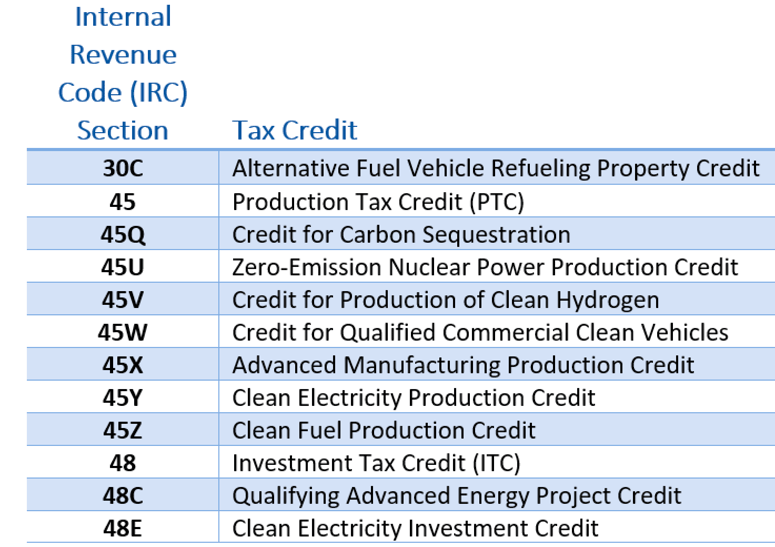

The IRA extended many federal energy credits to encourage taxpayers to invest in clean energy technologies. For example, the IRA extended both the Section 48 Investment Tax Credit (ITC) and the Section 45 Production Tax Credit (PTC), which award credits to investors who build renewable energy systems, calculated as a percentage of costs. The complete list of other federal energy credits extended or impacted by the IRA are listed below.

What does refundability mean?

Direct Pay of Energy Credits (IRC Section 6417)

Refundability is often referred to as “direct pay”. The IRA created a “direct pay” option for federal energy credits that allows certain entities to treat energy credits as direct payment of federal income tax. If those “payments” of tax happen to result in an overpayment, those organizations can get their overpayment refunded. In effect, this direct pay option turns a nonrefundable credit into a tax payment that’s refundable.

Tax exempt entities, state and local governments, and tribal entities can make the direct pay election for nearly all federal energy credits, but for-profit businesses can only make the direct pay election for the following three credits:

- Section 45V, Credit for Production of Clean Hydrogen

- Section 45Q, Credit for Carbon Sequestration

- Section 45X, Advanced Manufacturing Production Credit

Any entities wishing to use this direct pay option must make an election when filing their tax returns, and partnerships and S corporations must make the election on behalf of their owners.

What does transferability mean?

Transferability of Energy Credits (IRC Section 6418)

Because the direct pay option under IRC Section 6417 is mostly available to entities exempt from tax, the IRA created an incentive that taxable entities can take advantage of. If taxable entities don’t have enough tax liability to absorb an energy credit that they’ve earned, they can sell their credits to another taxpayer who can use it.

Entities can transfer their energy tax credits to another taxpayer as long as:

- Payments are received in cash.

- Payments are not treated as income by the recipient nor as a deductible expense by the payer.

- The same credit isn’t transferred more than once.

- The two parties are unrelated.

Like IRC Section 6417, entities wishing to transfer their credits must make an election to do so.

All federal energy credit listed above except for the Credit for Qualified Commercial Clean Vehicles under IRC Section 45W are eligible for transfer.

What are the Issues?

One issue is the utilization of the credits by the transferee. The proposed regulations provide that the passive activity credit rules under IRC Section 469 apply to a transferee in determining whether the transferee is eligible to claim the purchased credits. Accordingly, the transferred credits may only be used to offset passive trade or business income. This proposed provision makes it difficult for most individuals, S Corporations and closely held C Corporations to use the tax credits they purchase.

Takeaways

The direct pay election and transfer option introduced by the IRA provide more opportunities to monetize energy credits. While refundability will allow tax-exempt entities to benefit from cash refunds, and transferability may provide an expanded base of potential investors, there are still many questions to be answered. The Proposed Regulations, issued on June 14, are only a first step toward providing clarity on refundability and transferability. One key area of the proposed regulations that is open for comment, is the utilization of the credits by the transferee. A public hearing on the proposed regulations is scheduled to be held on August 23, 2023, with written or electronic comments to be received by the IRS by August 14, 2023. Please contact us with any questions.

Angelina is a Vice President in Meaden & Moore's Tax Services Group with more than 30 years of experience.