Was There an Actual Loss Sustained?

What does actual loss sustained mean? This can be a complicated question and the answer involves insuring agreement consideration for which accountants are not engaged to perform. However, as accountants, we are tasked with evaluating if there was an actual loss sustained. Therefore, from an accounting perspective, we have extensive experience with the actual loss sustained concept and Business Interruption loss measurement. In this article we discuss the concept of actual loss sustained and provide two case studies to review the topic.

How to Define Actual Loss Sustained

Generally speaking, the actual loss sustained is the negative financial impact to a named insured, as the result of a loss event, incurred during the period of liability. Another way to explain the actual loss sustained is if the estimated loss were stacked on top of the actual results during the period of liability, business operations should appear as if no loss had occurred. The stacked loss measurement would be before any deductibles, exclusions or limitations that may apply.

When assessing the impact of a loss event on any business operation, it is customary to address many issues including but not limited to:

- Nature of the business

- Financial performance of the business

- Ability to resume operations in whole or part

- Opportunity to temporarily relocate, or outsource production or services

- Use of inventory (i.e. sales from inventory during loss period)

- Working extra time or the use of overtime

While each of the issues above can be individually significant, many are interrelated and should be considered in totality when evaluating if there was an actual loss sustained. Every loss is unique and the loss event, the facts and circumstances, and the impact on business operations, should be evaluated for each separate occurrence.

Case Study – Hotel

A simple example to illustrate the actual loss sustained concept is to examine a hypothetical hotel loss for a 100-room hotel that sustains physical damage that results in 20 rooms being out of operation for three months.

If we were to calculate the lost revenue based on the projected room rate for the 20 impacted rooms, multiplied by the number of lost room nights for the period of liability, we would calculate the revenue that could be generated during the period of liability, assuming all rooms were occupied every night. However, depending on the occupancy levels of the hotel, this may not produce an accurate measurement of the actual loss sustained.

To illustrate why, we can review the two scenarios below:

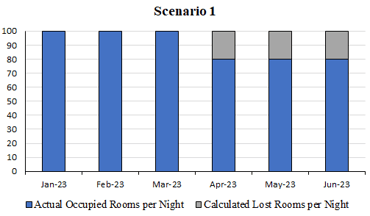

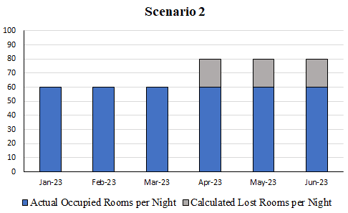

- Scenario 1 – the insured had pre-loss occupancy of 100% equating to 100 occupied rooms per night.

- Scenario 2 – the insured had pre-loss occupancy of 60% equating to 60 occupied rooms per night.

In Scenario 1, if we project occupancy to have remained at 100% during the period of liability, including the lost revenue for the 20 impacted rooms, we would effectively measure the actual loss sustained. Including the impacted rooms in the loss measure would result in a projection that is consistent with the pre-loss average.

However, in Scenario 2, if we project that the insured would have been able to accommodate all guests in the 80 undamaged rooms, including the lost revenue for the 20 impacted rooms would not measure the actual loss sustained. We would effectively be projecting 80 occupied rooms per night, which would be inconsistent with the pre-loss period of 60 occupied rooms per night.

Obviously, in a ‘real-life’ scenario, the occupancy data would be more complex and require consideration of many factors; however, this simplified example illustrates the importance of “stacking” the loss measurement on top of the actual performance of the business to see if you are measuring the actual loss sustained.

Case Study – Manufacturing

Another more complex example would be to examine two similar manufacturing business operations that incur the same type of damage, for the same period of time, however, they sustain a much different Business Interruption loss. Perhaps one of the business operations is in a stronger inventory position at the time of the loss, or one has the opportunity to repurpose a production line or restart an idle line to recover production. The actual loss sustained will potentially be much different for each of the two similar businesses that incurred apparently similar losses.

It is customary for the Business Interruption insuring agreement to include the net sales value of production for manufacturing operations. However, the negative financial impact to the named insured must be sustained/measurable. In other words, an actual loss sustained must be incurred during the period of liability. That means that any lost production must result in an actual loss of sales, during the period of liability, and after considering the customary loss impact issues listed at the beginning of this discussion, and potentially others.

Sticking with manufacturing operations, let us dive deeper into a first-party Business Interruption property loss example and what may impact the actual loss sustained. In a total suspension of operations, the sales value of lost production would theoretically result in the same sales shortfall measurement, if the manufacturing operation does not have an opportunity to mitigate their loss, and there are not any issues that limit recovery such as a limited number of days for the extended period of indemnity.

But what if the business outsources some production? Or what if the total suspension of operations is twenty-four days but the insured has forty-one days of inventory on-hand?

In that case, a Business Interruption claim based on the sales value of lost production may not represent the actual loss sustained. Meaning, a production-based Business Interruption claim compares anticipated production to actual production and then applies a sales value to the production shortfall. However, if actual sales remain unchanged during the period of liability due to outsourcing and sales from inventory, the sales value of the lost production would not represent the actual loss sustained.

In this manufacturing example, the actual loss sustained, or the negative financial impact to the named insured would include the result of anticipated sales less actual sales achieved during the period of liability. Simply claiming the sales value of lost production, without a proper evaluation of the sales achieved during the same period will not measure the actual loss sustained. In addition, the actual loss sustained would include incremental costs to outsource production, incremental costs to continue operations in whole or part, and incremental costs to rebuild/recover inventory.

The lesson learned in this manufacturing example is that the sales value of lost production must be validated with a sales study. Also, while a 100% production shortfall may exist initially after a loss, advance payments requested based on the sales value of lost production should be closely examined and the actual loss sustained must be confirmed. This is because of the potential for outsourcing, sales from inventory and production recovery at the location or another named location.

To illustrate this further, we can review the two simple scenarios below:

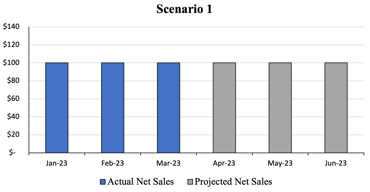

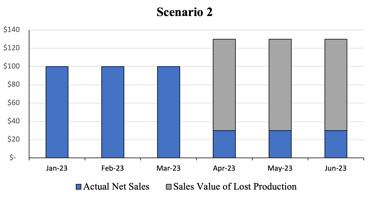

- Scenario 1: the insured had pre-loss net sales of $100 a month and was unable to mitigate their loss.

- Scenario 2: the insured had pre-loss net sales of $100 a month and was able to partially mitigate their loss and generate $20 of net sales a month.

For both scenarios, we assume that net sales for the three-month period of liability (April – June 2023) would be consistent with the prior three months (January – March 2023). In both scenarios, after calculating lost revenue, we would also need to account for any non-continuing expenses, deductibles, exclusions, and limitations that may apply.

In Scenario 1, by calculating the loss based on the net sales value, the sales shortfall is measured which represents the actual loss sustained, as the pre-loss sales are consistent with the measurement for the period of liability.

In Scenario 2, the sales value of lost production is stacked on top of the actual net sales value achieved during the period of liability. Sales in this scenario would overstate the loss and not reflect the actual loss sustained because we would effectively be projecting sales of $120 per month when the pre-loss sales were only $100.

Conclusion

The concept of the actual loss sustained can be simply defined as the negative financial impact to a business. However, as discussed above, this is often not as simple as it sounds, and it is always necessary to look at the “bigger picture” and wider operations of a business to accurately calculate the actual loss sustained. As detailed above, it can be helpful to “stack” the estimated losses on top of actual results during the period of liability to assess if the actual loss sustained is being considered. In this article we have reviewed two examples of losses in the hotel and manufacturing sector; however, there are infinite examples of where the calculation of the actual loss sustained can be more complex than it initially appears.

*This blog was co-written by Hannah Dingley. Hannah has over a decade of forensic accounting experience and specializes in insurance matters, commercial litigation, and fraud investigations.

Andy has over twenty years of public accounting experience and specializes in forensic accounting services for the legal and insurance profession. He has been designated as an expert and testified in Federal and State courts on a variety of matters including commercial insurance claim evaluations, contract disputes, loss of profits, personal injury, wrongful death, professional liability, and white collar crime. He has also been appointed as an Appraiser on a variety of commercial property insurance disputes.