Understanding Developer Fees in Builder’s Risk Claims

Introduction

In builder’s risk insurance, coverage often extends beyond physical damage  ("hard costs") to include indirect expenses ("soft costs") stemming from project delays or losses. One particularly critical cost category is the developer fee—a profit and overhead payment due to the developer for organizing financing for the project and overseeing construction. This article explores why developer fees draw scrutiny, how they fit within claim framework, and how to address them clearly and fairly within the measurement of an economic loss, provided there is coverage.

("hard costs") to include indirect expenses ("soft costs") stemming from project delays or losses. One particularly critical cost category is the developer fee—a profit and overhead payment due to the developer for organizing financing for the project and overseeing construction. This article explores why developer fees draw scrutiny, how they fit within claim framework, and how to address them clearly and fairly within the measurement of an economic loss, provided there is coverage.

What Is a Developer Fee?

A developer fee is the compensation a project developer earns for organizing the financing, hiring contractors, and managing the project—typically structured as a percentage of total project costs, or based on specific milestones of the project, (i.e. notice to proceed, 50% completion, certificate of occupancy). This encompasses both overhead and profit. Developers often set rates between 3% and 5% of hard or total costs (or total development costs) (e.g., $3 million on a $100 million project over ~3 years). This fee is not arbitrary; it is usually defined in a developer agreement (e.g., paid by an LLC or project entity). It may be calculated based on hard or soft costs—or both—according to that contract.

Critical Analysis of the Fee

The developer fee can function as a return on equity, capturing owner profits rather than actual costs, but usually it is meant to cover the developer’s overhead for organizing the project. A key question is whether a delay or loss results in additional developer costs and whether the developer purchased coverage for the costs associated with overseeing the loss / delay related work. If the development team’s salaries (fixed overhead) are extended, there's no incremental cost. However, the developer is expending additional time and effort associated with overseeing the loss related work.

Developer Fee as a Soft Cost

Soft costs are indirect expenses incurred due to delays—such as additional loan interest, permit fees, and in this case, developer overhead. Normally, builder’s risk policies don’t include soft costs unless endorsed. Developers consider their fee a component of soft costs, since only they bear the cost, and loss of time directly impacts their financial return and financial interest. There are instances where the developer’s fee is part of the hard cost section of the coverage. It’s important to differentiate between developer fees and the general contractor’s fee and interests, which are captured in the contractor works section of the insurance policy.

Justifying Developer Fees

Developer agreements usually specify basis: for example, '3% of hard costs' or '3% of total development costs.' Clear contract wording ensures the fee is calculated consistently—e.g., applied only to eligible cost categories. These agreements form the evidentiary support insurers require to validate the fee inclusion in a claim.

Handling Claims Involving Developer Fees

Insurers may explicitly allocate developer fees as a covered soft-cost category with tailored premium. The formula for calculating the developer fee often reads: (Hard Costs + Soft Costs) × Developer Fee % = Developer Fee. Since inclusion increases exposure, insurers may charge premium reflecting the risk and set sublimits, caps, or percentage limits to avoid or minimize unintended consequences. Policy wording may reference the developer agreement, delineate cost bases, and specify applicable percentage rate.

Case Example:

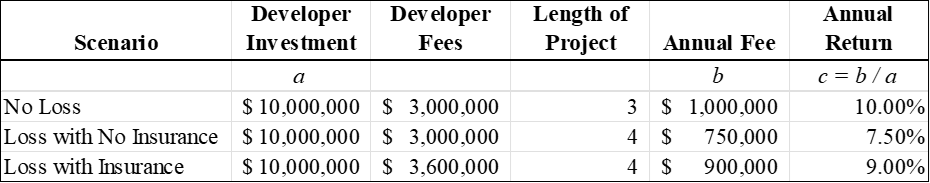

A developer invested $10 million of equity into a $100 million apartment construction project, with the remaining $90 million financed through debt. As part of the development agreement, the developer was to earn a fee of 3% of the total project value—$3 million—for organizing, permitting, and managing the project. This fee provides compensation for the developer’s time, risk, and effort over a multi-year time interval, and is paid out of the project funds

Some people believe the developer is simply paying themselves, but in reality, the fee reflects the cost of investing capital and coordinating the entire development process. On the surface, the fee may seem generous when compared to the invested capital (3% on $10M in invested capital = 30%). When viewed over a three-year timeline, the return was closer to 10% annually—not an excessive profit, but a reasonable return for the work and risk involved.

During the course of construction, a covered event causes $20M in damage and a 12-month delay. The developer submits a claim for 3% of the damage amount—$600,000—based on their original agreement. While they may not have spent an extra $600,000 directly, their capital is now tied up longer, and they may miss out on other opportunities to deploy their capital, unrelated to the insured project. This cost may reflect an economic setback due to the delay. Consider that their $10M capital is now tied up an additional year, or 4 years in total, with the development team overseeing the repair and delay related work. Earning an additional $600k yields a return of under 8% over that same time period if no insurance is provided.

Key Takeaways from Case

Developer fee coverage often hinges on whether the cost is explicitly spelled out in the policy and whether it is a hard or soft cost. Clear endorsements outlining eligible soft cost categories, including developer fees, and coverage for additional insureds are vital.

Courts expect developer fees to be supported by a written developer agreement and calculated per policy-endorsed terms. To prevent inflated claims, insurers may include sub-limits or caps tied to total loss values or percentages.

Policy Approaches to Avoid Disputes

-

Secure developer fee endorsements that explicitly define the fee (%) and applicable cost bases in the policy.

-

Require developer agreement submission to support claims.

-

Apply careful claim scrutiny to validate that delay caused incremental cost—not simply a shift of preexisting overhead.

-

Utilize sublimits to cap developer fee recovery (e.g., 3% of total cost or loss, or a dollar sublimit).

Conclusion

These cases underscore the vulnerability of developer fee claims within builder’s risk coverage unless policies are clearly tailored, endorsed, and supported by documentation. By proactively addressing these gaps and developing a clear understanding of the fee—through endorsements, developer agreements, validation practices, and sub-limits—insurers and insureds alike can balance coverage for genuine expenses against protection for perilous events.

This article was co-authored by:

Eric Rapp, CPA, CFE – Vice President, Columbus, OH

Patrick Kelleher, CPA / CFF – Senior Partner, Boston, MA

Eric T. Rapp serves as a Vice President in Meaden & Moore’s Investigative Accounting & Litigation Support practice. Since joining the firm in 2012, he has dedicated his career to serving the insurance industry and legal profession. Eric provides a wide variety of investigative and forensic accounting services, including insurance claim evaluations and litigation support across complex loss and dispute matters.