How Higher Interest Rates Have Impacted Transaction Activity

Since the Federal Reserve started to increase interest rates, I have seen a slight decrease in values for some companies, as would be expected in this environment, but not to any significant degree. Instead, I’ve seen more significant changes in value because of earnings expectations, not interest rates. And not always downward.

The impact of rising interest rates on lower middle market M&A can be complex. Here are some potential ways that higher interest rates have impacted transaction activity:

- Higher borrowing costs: As interest rates have risen, borrowing costs for businesses have obviously increased. This makes it more expensive for companies to finance transactions. As a result, some companies may choose to delay or cancel M&A activity, which could slow down deal flow.

- Increased competition for deals: As the cost of capital has increased, investors have become more selective about the deals they pursue. This leads to increased competition for deals in the lower middle market as investors seek out companies with strong growth potential and attractive valuations.

- Impact on valuation multiples: Higher interest rates also impact the valuation multiples used to assess the value of companies in M&A transactions. Higher interest rates lead to higher discount rates (therefore lower valuations), which could impact both buyers and sellers in lower middle market M&A.

- Shift towards equity financing: Rising interest rates may also lead to a shift towards equity financing, as companies seek to avoid higher borrowing costs. This could make it more difficult for companies to secure debt for M&A transactions, leading to a greater reliance on equity financing.

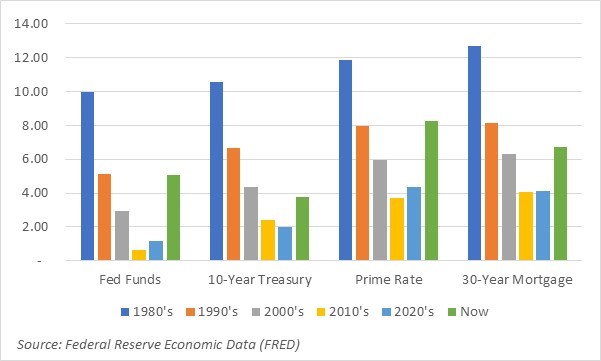

Here’s an interesting little chart that shows the averages for a few different rates by decade. As you can see, current rates are about where they were prior to the great recession, but not anywhere near the 1980’s.

Tell me what's on your mind. Write me at lbell@meadenmoore.com or try the old fashioned way by calling 216-928-5360.

Lloyd W.W. Bell III is Director of the Corporate Finance Group at Meaden & Moore. He has over 30 years of experience in financial management.