2023 Lending Environment Outlook, and What's Expected in 2024

The post-COVID lending market has been nothing short of a whirlwind. In a matter of months, banks, lenders, investors, and anyone looking to acquire debt saw the markets shift right before their eyes. Borrowing became more costly, and as their financial futures became much less certain, investors had to change their plans.

Although we cannot be certain where 2024 will take us, our professionals have an idea of where we’re headed. Let’s review what happened in 2023 and figure out how we can best prepare for the year ahead.

Rising interest rates have driven change.

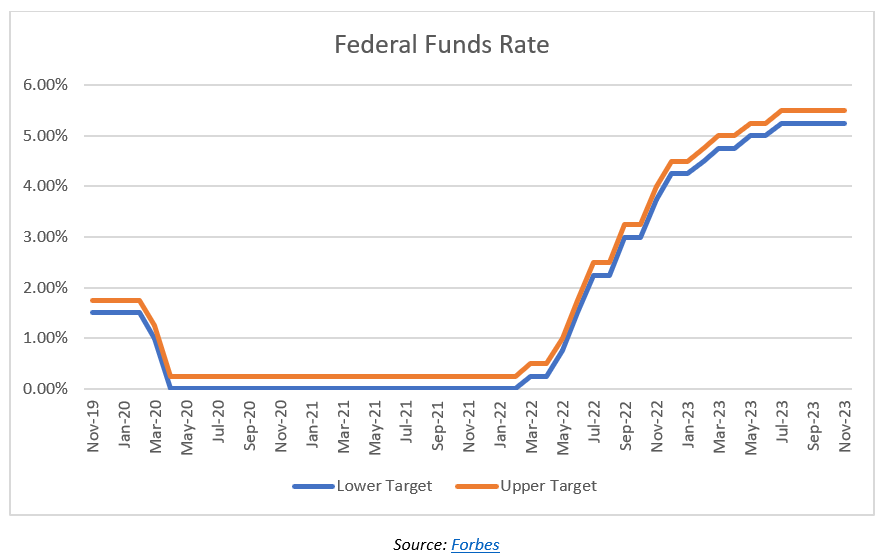

As the economy rebounded from the COVID-induced economic recession, interest rates skyrocketed. Since March of 2022, the Federal Reserve has raised interest rates 11 times, and today, the federal funds rate is the highest it has been since just prior to the 2008 housing crisis. Although the rate hikes have ceased, rates may stay at current levels until the third quarter of 2024.

The federal funds rate is the interest rate at which commercial banks charge each other for overnight lending. The prime rate, which is the interest rate at which private banks and other depository institutions charge each other for overnight lending, is typically 3% higher than the federal funds rate and is often used as a benchmark for other short-term loans like credit card, home equity lines of credit, and small business loans.

This extreme change in interest rates has had a notable impact on the lending market. Over the past year or so, we’ve witnessed some of the following changes:

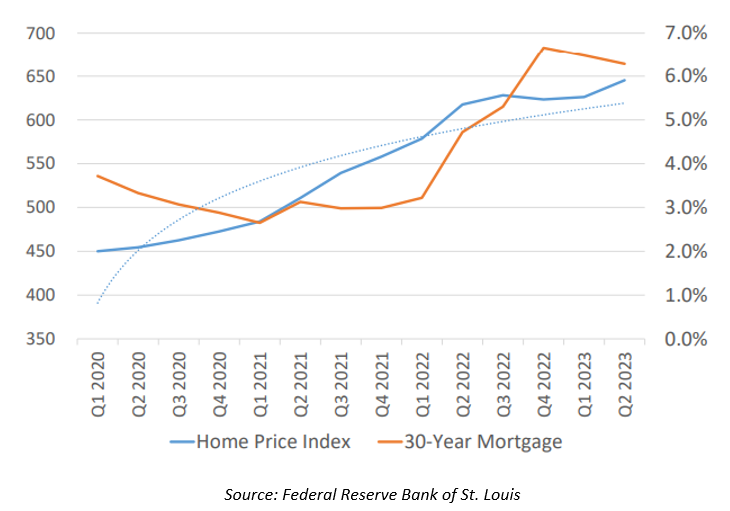

Home prices and mortgage interest rates have risen.

It’s no surprise that mortgage rates have risen alongside federal borrowing rates. The average 30-year residential home mortgage rate for Q2 2023 is up 28% from a year ago and up 90% from two years ago. Despite this increase, the US housing price index (HPI), which measures the price changes of residential housing, has followed suit. The Q2 2023 US HPI is up 4.3% from a year ago and up 26% from two years ago.

Businesses are decreasing investment in new equipment.

When the cost of borrowing rises, fewer businesses are willing to invest in new machinery or equipment. The Equipment Leasing and Finance Association (ELFA) reported that US companies borrowed 8% less to finance equipment investments in October 2023 compared to October 2022.

---------------------------------------

[1] 30-yr fixed mortgage rates: 4/7/21: 3.32% ● 4/6/22: 4.95% ● 4/5/23: 6.32%

[2] United States Housing Price Index: Q2 2023: 645.18 ● Q2 2022: 617.63 ● Q2 2021: 510.95

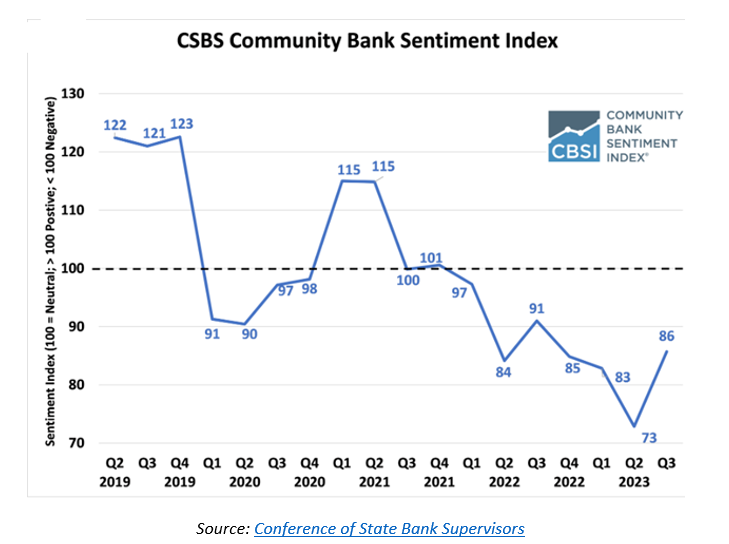

Lenders are less certain about the future.

Banks and other lenders have reported a less favorable outlook for the year ahead. The Community Bank Sentiment Index, which measures community bankers’ outlook on the economy, continues to be negative, for the seventh quarter in a row.

A few of the things bankers are concerned about are:

- The Federal Reserve’s monetary policy decisions

- Regulatory burdens

- Threat of cyberattacks

- The federal deficit

- The cost and availability of labor and inflation

- New accounting standards

This fear manifests in different ways. Over the past year, we’ve seen banking operations and lending policies change, often dramatically. For example, we’ve noticed that banks and other lending institutions have implemented more stringent standards for commercial business loans. They have done this by:

- Charging premiums on riskier loans.

- Increasing costs for lines of credit.

- Implementing maximum credit limits on lines of credit that previously had no ceiling.

- Changing covenant ratios.

- Boosting collateral requirements.

- Applying an interest rate floor to all loans, regardless of loan size or business size.

- Charging higher fees on loan closings.

The bottom line is that lenders are scared. Banking leaders are doing everything in their power to mitigate the risks that uncertain lending environments pose, and business owners must work to adapt to those new expectations.

Borrowers need capital but have trouble acquiring it.

Access to capital has become a chief concern for privately held businesses.

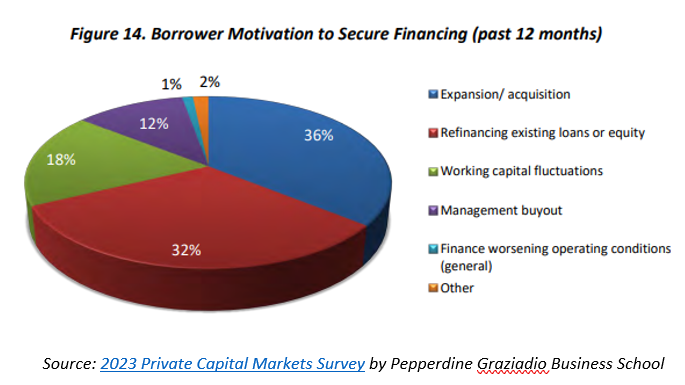

Borrowers need capital for a variety of reasons. In the past 12 months, business expansions and acquisitions have been the top reason to secure financing, with loan refinancing coming in at a close second.

The need for capital is there, but the changing underwriting standards make it more difficult to get approved for a loan. A slight change to loan covenants could push businesses out of eligibility. Consider the debt service coverage ratio (DSCR) for a moment. DSCR measures a business’ ability to pay its current debt obligations. The DSCR is typically calculated by dividing EBITDA by required debt payments (both interest and principal). A DSCR of 1.0 shows that a business can cover exactly all of its debt payments without a cent to spare, so many banks require DSCRs of 1.5 or higher.

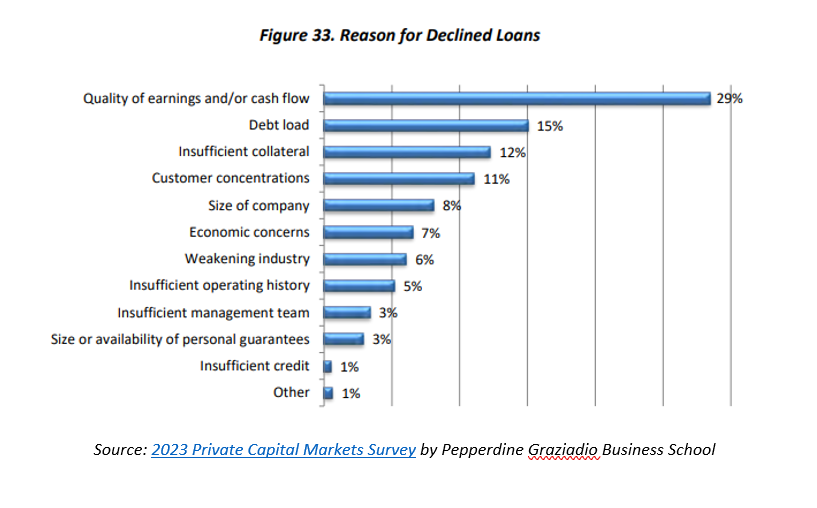

Right now, the average DSCR for borrowers is 1.3. If banks change their debt covenants to require an even higher DSCR, businesses may become ineligible for new loans. Statistically, this already appears to be the case. The number one reason loan applications were denied this past year were for lack of cash flow or for quality of earnings concerns.

The ability to get approved for a loan is only one piece of the puzzle. According to results from the 2023 Private Capital Markets Survey, a few other reasons why borrowers struggle to obtain financing are:

Financing costs are out of reach.

53% of survey respondents said that loan fees have increased this past year.

Lenders have less of an appetite for risk.

93% of respondents said that their appetite for risk has decreased.

Borrowers may not be able to collateralize their loans.

17% of respondents noticed that there was an increase in loans that required collateralization, and 42% of respondents said that collateral is the main focus as a backup means of payment.

Loan sizes have increased.

27% of respondents said that the average loan sizes have increased in the past year. This could be, in part, because businesses are relying less on the federal government to subsidize their loans. 56% of respondents said they saw a decrease loans underwritten by the Small Business Administration.

What can we expect in 2024?

The lending environment in 2024 is difficult to predict. Bankers and borrowers alike need to be flexible as interest rates change, as regulators change their requirements, and as new government programs get implemented. Forecasting your financial future is difficult with so many different assumptions in flux, so it’s important you work with a financial expert you trust when planning for the year ahead. Our Meaden & Moore consultants and accounting experts are ready to walk you through the different possible outcomes so that you are prepared for whatever 2024 brings.

---------------------------------------

[1] The Pepperdine Private Capital Markets Survey is a survey of senior lenders, asset-based lenders, mezzanine funds, private equity groups, venture capital firms, angel investors, privately-held businesses, investment bankers, business brokers, limited partners, and business appraisers.

For more information about the 2023 Lending Environment Outlook, reach out to us today.

Lloyd W.W. Bell III is Director of the Corporate Finance Group at Meaden & Moore. He has over 30 years of experience in financial management.