Key Considerations for the Measurement of Builder’s Risk Insurance Losses Part 1: Property Damage, Expediting and Other Costs

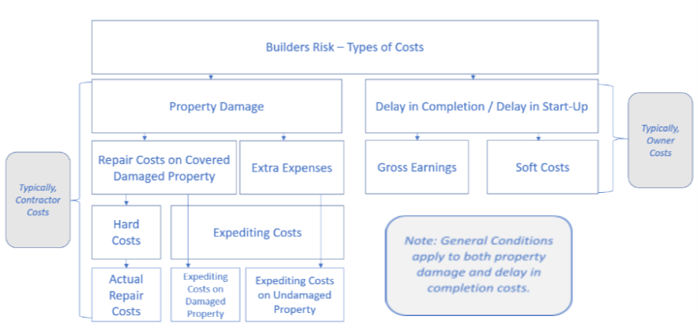

Builder’s Risk Insurance is a type of insurance that protects insureds from covered damages incurred while a building is under construction. There are several categories of costs to be considered when evaluating a Builder’s Risk claim, including property damage, acceleration charges, extra expenses, and expediting costs. Many of these costs originate as a result of repair related work and are incurred by the general contractor and subcontractors and are passed along to the owner entity of a project. Gross earnings losses and delays in startup costs are typically incurred by the owner and will be discussed in Part Two of this article series.

Builder’s Risk Insurance is a type of insurance that protects insureds from covered damages incurred while a building is under construction. There are several categories of costs to be considered when evaluating a Builder’s Risk claim, including property damage, acceleration charges, extra expenses, and expediting costs. Many of these costs originate as a result of repair related work and are incurred by the general contractor and subcontractors and are passed along to the owner entity of a project. Gross earnings losses and delays in startup costs are typically incurred by the owner and will be discussed in Part Two of this article series.

Property damage (“PD”)

Property Damage relates to the costs incurred to return the building back to its original state prior to the loss event. For example, if windows were destroyed by hurricane winds, the costs associated with replacing those windows fall under the property damage category. These are typically described as the “hard costs” of a builder’s risk loss.

Expediting Costs – What are these and where do they factor in the consideration of a Builder’s Risk Loss?

Expediting costs are costs that are incurred by the insured to speed up the repair of damaged property with the goal of reducing the “delay in completion” period. A simple example would be paying for air freight instead of rail freight for materials needed to affect repairs. Air freight may be more expensive, but it may result in faster delivery of critical materials. Another example would be paying for a larger crew size or paying additional overtime in order to speed up the repair process with raw manpower.

These decisions may not be clear cut. For example, a larger crew may work faster but be less efficient. Additional hours with the same headcount or manpower means higher rates, including overtime and double-time rates, but also more work completed in a shorter duration. It can be helpful to consider these costs in the context of any ongoing loss of earnings/soft costs and calculate if any expediting costs are worthwhile incurring in order to mitigate additional losses and get the business operational as soon as possible. For example, if an insured is losing $1 million of income a month and an expediting cost of $500,000 will reduce the repair period by several months, it is clearly economically beneficial to incur the expediting cost. However, if the insured is losing only $100,000 of income a month, the expediting cost would not be economically beneficial.

Often times, it is critical to evaluate the labor and other costs in conjunction with the adjusting team so that expediting costs are properly categorized and separated from acceleration charges to non-damaged property and construction work that would have occurred independent of the loss.

How are Expediting Costs different from Extra Expenses?

Costs associated with accelerating non-damaged work to maintain the project schedule are traditionally categorized as extra expenses or a category that is independent of expediting charges. Acceleration charges should be analyzed so that only the premium portion of the work is considered, and any construction related activities that were to occur regardless of the loss are excluded from the measurement entirely. Acceleration charges related to undamaged property may be categorized as extra expenses if certain criteria are met.

What Are General Conditions?

General condition costs include all of the items and resources needed for a project that will ultimately not be part of the finished product turned over to the owner. This could include costs related to garbage removal, temporary offices, security, project supervision, and administrative expenses.

General conditions are an integral element of any construction project and can factor into the property damage component, or the delay portion of the risk, or both. Delay related general conditions are often referred to as extended general conditions.

What are Extended General Conditions?

Extended general conditions claims typically relate to costs incurred as a result of an extension of the original construction contract, often based on the number of days of delay in construction. It is important to identify if these costs are related to the loss event or a delay that is wholly independent of the loss.

General conditions may include fixed costs, such as a monthly trailer rental. If the claim presents extended general conditions based on the average general conditions cost per day in the original contract multiplied by the number of days in the delay period, this may potentially overstate the actual costs incurred by the contractor during the delay as general conditions during the tail end of a project are often less than the “average” general conditions. It is thus important to review the contract between the owner and the general contractor and general ledger detail of costs incurred during the entire project, including pre-incident and post-incident costs.

It’s important to note that the additional contractor costs associated with the delay are not typically included in the time related costs that are traditionally referred to as ‘soft costs’ and specifically delineated in the delay in completion wording in the insurance contract.

Conclusion

It is critical to analyze and understand the costs that are submitted as part of a builder’s risk claim. This includes dissecting the costs that are typically submitted as a single line item by the contractor and other stakeholders. An accounting analysis, including categorization of costs, is important to properly understand the costs and how they impact the overall project, its timeline, and other intervening factors, loss related or otherwise.

Part Two of this series will focus on gross earnings loss and delay in startup costs including an explanation of soft costs.

This blog was cowritten by Benjamin Reifenberg.

Patrick Kelleher, CPA, CFF, has nearly two decades of experience working in the area of forensic and investigative accounting field. He has extensive experience in the commercial insurance claims area, evaluating claims of financial damages, including business income, property and fidelity matters ranging from $50,000 to $150 million in damages.