Fraud and Forensic Accounting Services

Whether you need an alternative source of information or a unique method of damage measurement, Meaden & Moore’s investigative accounting professionals have the knowledge and experience to provide innovative, credible support.

Dedicated Resources

For over half a century, Meaden & Moore’s Investigative Accounting Group has provided insurance claim evaluations across all coverages, forensic examinations, fraud and financial investigations, contract examinations, dispute resolution services, and litigation support for all phases of insurance events, contracts, and business disputes. We effectively deliver investigative services to insurance companies, independent adjusters, legal counsel, and owners in both the public and private sectors.

Our clients count on our expert assistance in preparing interrogatories and requests for documents. Our professionals also attend depositions of fact, assist in reviewing the opposition’s work product, and help develop probing questions designed to uncover financial facts essential to each case.

Expert Assistance for Your Complex Matters

Our experienced professionals are dedicated to providing forensic accounting services. Our leaders are Certified Fraud Examiners (CFE), Certified Public Accountants (CPA), and Certified in Financial Forensics (CFF).

As CFEs, we are members of the Association of Certified Fraud Examiners, whose members specialize in the detection, prevention, investigation, and deterrence of fraud. As CPAs, we are members of the American Institute of Certified Public Accountants (AICPA), and the AICPA awards the CFF to CPAs who demonstrate highly specialized expertise in forensic accounting. We are also members of the Institute of Internal Auditors and several other organizations associated with the insurance and legal professions.

Virtual Currency & Blockchain: Emerging Insurance Industry Issues

The insurance industry is transforming daily. Digitized assets and innovative financial channels, instruments, and systems will be, and are, impacting the insurance industry – including blockchain technology and virtual currencies like Bitcoin.

INDUSTRY-LEADING INSIGHTS

Delivering insights and points of view on vital news, strategies to consider, technology developments, and current topics that are important to your business and personal financial success. Check here for content from Meaden & Moore professionals.

Measurement Issues in Cyber Claims

While no one is completely protected from a cybersecurity breach, some of the risk can be transferred through cyber insurance coverage.

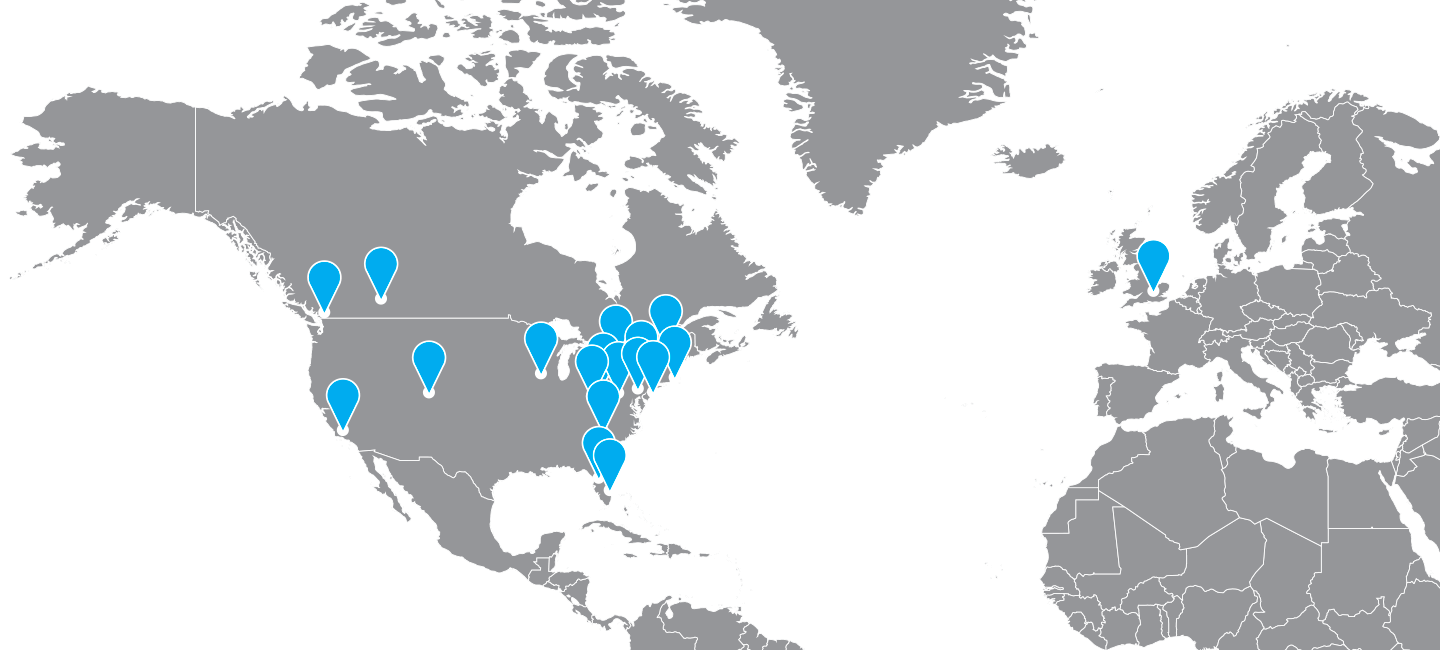

Locations

Meet Our Experts

At Meaden & Moore, our people are our most vital asset, providing the strength behind our reputation, technical excellence, and top-notch quality service. Wherever your business operates, you can count on the leaders at Meaden & Moore to provide the comprehensive services you need.