Do you need an alternative source of information or a unique method of damage measurement? Meaden & Moore has amassed the knowledge and a depth of resources to provide you with innovative, credible litigation support.

Litigation Support You Can Trust

Meaden & Moore’s litigation support group applies experience and clarity to answer complicated financial questions in relevant simplified terms. Law firms, corporations, and private equity firms rely on our full-service litigation support team to avoid costly litigation. But when litigation becomes necessary, we will assemble an experienced team that knows how to help clients succeed with focused preparation, thoughtful analysis, and expert testimony.

Forward Thinking That Has Your Back

With the benefit of an AIFA® certified professional on staff, Meaden & Moore has a comprehensive understanding of fiduciary responsibilities, gained through successful completion of the training on a fiduciary standard. We complement that knowledge by training on ISO-like assessment procedures (i.e., Fi360). The result – enabling fiduciaries to conform to this standard of excellence.

Fi360 is the leading fiduciary training and resource organization in the United States. Every company that embraces Fi360 shares a common commitment to spreading the knowledge and application of the Prudent Practices for Investment Fiduciaries among brokers, investment advisors, financial planners, and other investment professionals in the U.S. and abroad. The Fi360 curriculum designers develop the AIFA's and other fiduciary training programs, which are delivered to thousands of investment professionals, advisors, and stewards every year.

Virtual Currency & Blockchain: Emerging Insurance Industry Issues

The insurance industry is transforming daily. Digitized assets and innovative financial channels, instruments, and systems will be, and are, impacting the insurance industry – including blockchain technology and virtual currencies like Bitcoin.

INDUSTRY-LEADING INSIGHTS

Delivering insights and points of view on vital news, strategies to consider, technology developments, and current topics that are important to your business and personal financial success. Check here for content from Meaden & Moore professionals.

Measurement Issues in Cyber Claims

While no one is completely protected from a cybersecurity breach, some of the risk can be transferred through cyber insurance coverage.

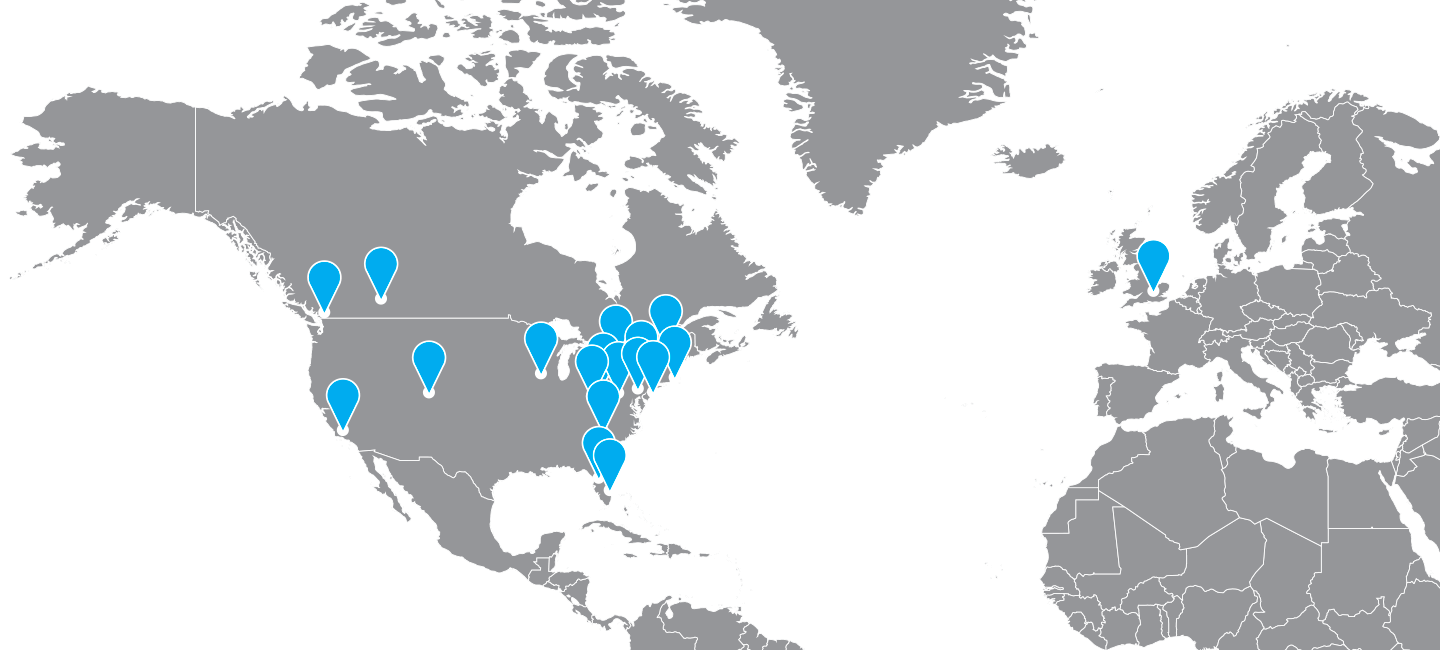

Locations

Meet Our Experts

At Meaden & Moore, our people are our most vital asset, providing the strength behind our reputation, technical excellence, and top-notch quality service. Wherever your business operates, you can count on the leaders at Meaden & Moore to provide the comprehensive services you need.